|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Mortgage Interest Rates Today in the USAMortgage interest rates play a crucial role in determining the affordability of homeownership in the USA. Keeping an eye on these rates can save prospective homeowners a significant amount of money over the life of their loan. Current Trends in Mortgage Interest RatesAs of today, mortgage interest rates are influenced by various factors, including economic indicators, federal policies, and market demand. It's essential to understand these dynamics to make informed decisions. Economic IndicatorsKey economic indicators such as inflation, employment rates, and GDP growth impact mortgage rates. When inflation rises, lenders often increase interest rates to maintain their profit margins. Federal Reserve PoliciesThe Federal Reserve's monetary policy directly affects mortgage rates. When the Fed raises the federal funds rate, it typically results in higher mortgage interest rates.

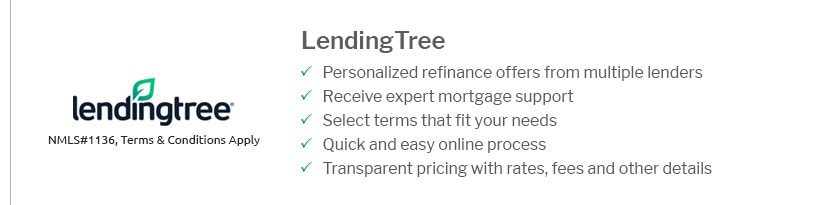

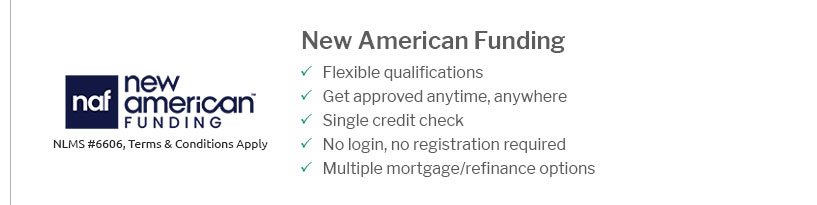

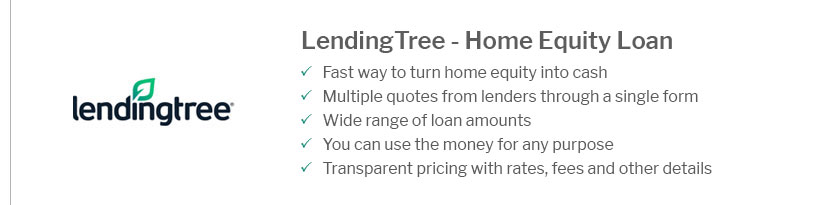

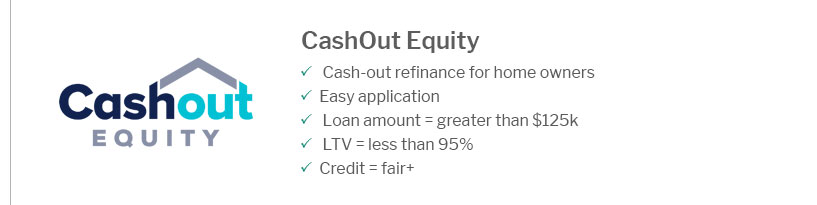

Types of Mortgage Interest RatesUnderstanding the different types of mortgage interest rates is essential for choosing the right mortgage plan. Fixed-Rate MortgagesA fixed-rate mortgage offers a constant interest rate and monthly payment throughout the loan term. This option is ideal for those planning to stay in their home for a long period. Adjustable-Rate Mortgages (ARMs)ARMs have interest rates that adjust periodically based on a specific index. They typically offer lower initial rates, making them attractive for short-term homeowners. Strategies for Securing the Best RatesSecuring a favorable mortgage interest rate requires careful planning and strategy. Improve Your Credit ScoreA higher credit score can significantly lower your interest rate. Paying bills on time and reducing debt can help improve your score. Shop Around for LendersDon't settle for the first offer. Compare rates from different lenders to find the best deal. Exploring options like a 280000 mortgage can provide valuable insights. Other ConsiderationsWhile interest rates are a key factor, they aren't the only consideration when choosing a mortgage. Loan TermsThe length of the loan affects the total interest paid. A shorter term usually means less interest but higher monthly payments. Home Equity LoansFor those looking to tap into their home's value, the best home equity loans offer competitive interest rates and flexible terms. FAQWhat affects mortgage interest rates?Mortgage interest rates are affected by economic indicators, Federal Reserve policies, and market demand. Inflation and employment rates are significant factors. How can I get the lowest mortgage interest rate?To secure the lowest rate, improve your credit score, compare offers from multiple lenders, and consider the loan term and type that best fits your financial situation. Is a fixed-rate or adjustable-rate mortgage better?It depends on your financial goals. Fixed-rate mortgages offer stability, while adjustable-rate mortgages might save money if you plan to move before rates adjust. https://www.schwab.com/mortgages/mortgage-rates

See more Conforming Loans ; IAP-eligible loan, Loan type, Rate (%), APR (%), Points (%) ; Yes, 10 Year ARM, 6.5%, 6.842%, 0 ; Yes, 5 Year ARM. Interest-only ... https://tradingeconomics.com/united-states/30-year-mortgage-rate

The average rate on a 30-year fixed mortgage backed by Freddie Mac dropped to 6.63% as of March 6th, marking its seventh consecutive weekly decline from an ... https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Feb 12 2025 2/12/25, 6.95%, 0.64, -0.07%, 6.80% ...

|

|---|